Sage Business Cloud Integration

SpotlerCRM integrates with Sage Business Cloud Accounting. Sage Accounting is an online accounting software that makes quick work of the daily tasks you know you need to get right. It’s easy to use and you can get started in minutes.

Sage Accounting integration with your CRM means you can create invoices directly from your CRM Opportunities and manage your product stock and services.

Please note, the Sage Business Cloud integration is currently only available for UK-based customers.

Getting Started with Sage Business Cloud Accounting

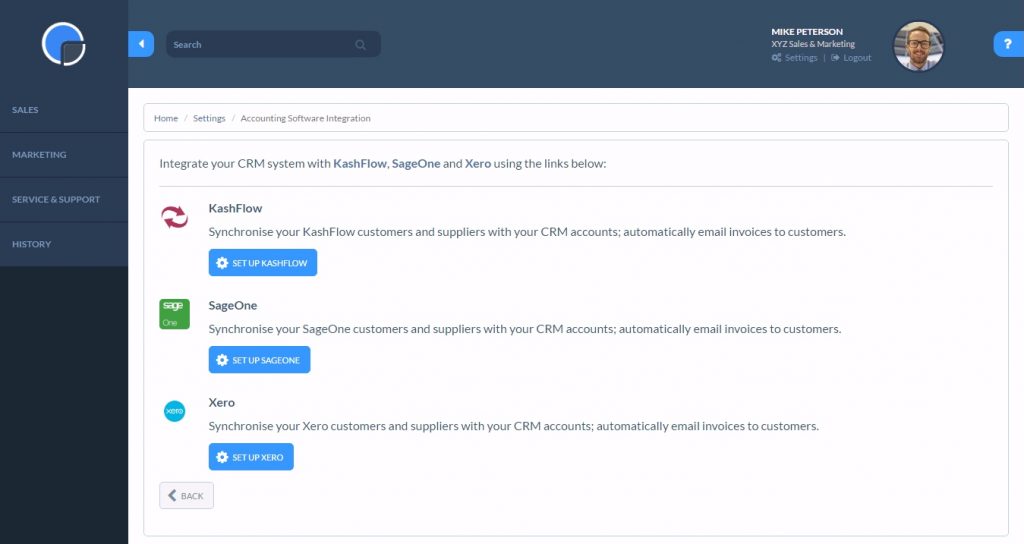

To integrate your CRM with Sage Accounting, first set up an account with Sage Accounting. Then in your CRM go to Settings / Integrations, open the Accounting Software section and click the Sage Accounting blue ‘Set-up’ button. Then follow the simple instructions to link your systems, allowing access to your Sage Accounting account.

Adding & Updating CRM Accounts in Sage Accounting

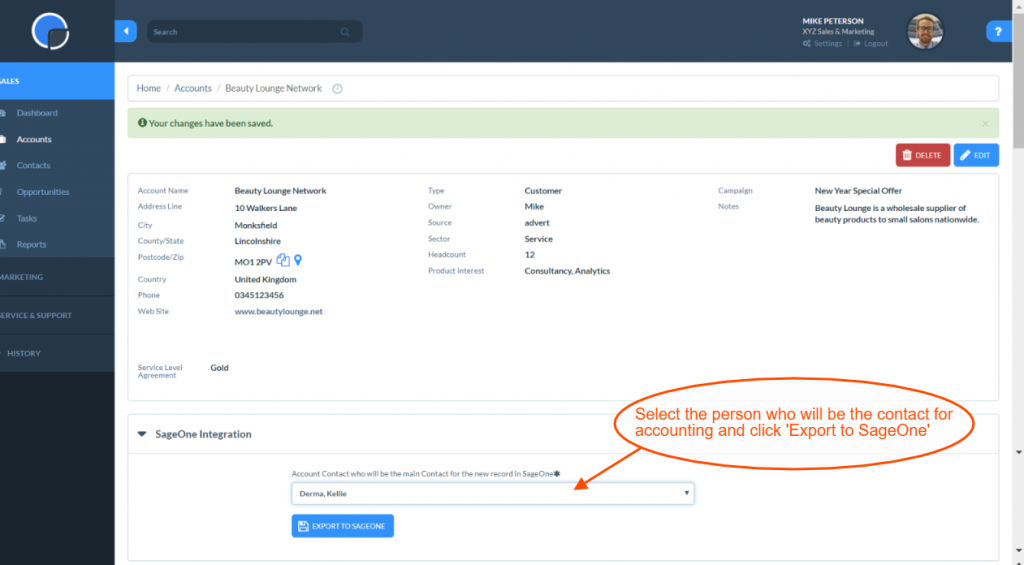

Your Sage Business Cloud integration lets you add CRM Accounts to Sage Accounting Customers (and suppliers if enabled), and update Sage Accounting records that are already linked, from the Account page. Simply open the customer account in your CRM and scroll down to the ‘Sage Accounting Integration’ section.

If you have more than one contact in the account you can select which contact to export to Sage Accounting, then click the ‘Export to Sage Accounting’ button.

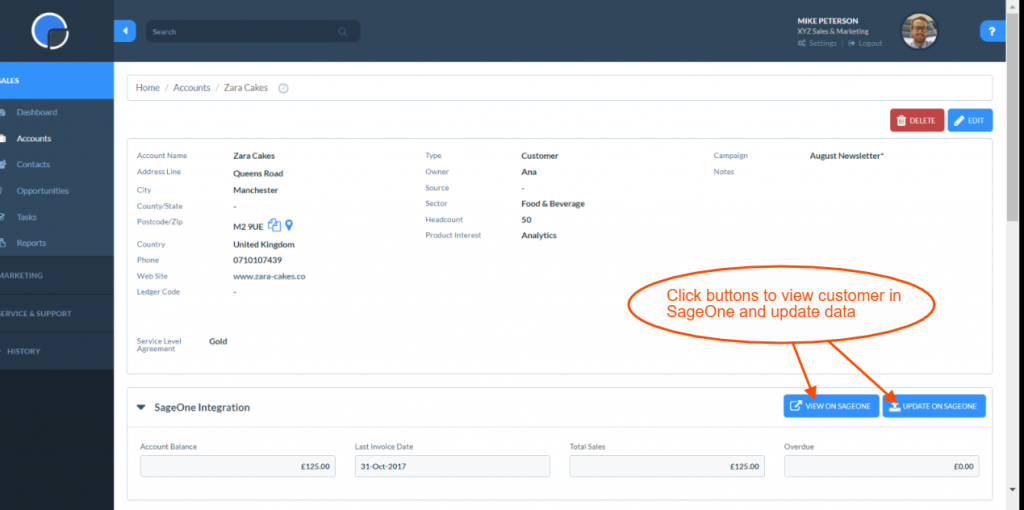

If the customer account exists already in Sage Accounting, you can click the ‘View on Sage Accounting’ button in your CRM and this will take you to their record in Sage Accounting. If you make any changes to the customer account, for example, the address, telephone number or contact name, then just click on ‘Update on Sage Accounting’ and this will update the record in Sage Accounting as well.

Import Customers from Sage Accounting to the CRM

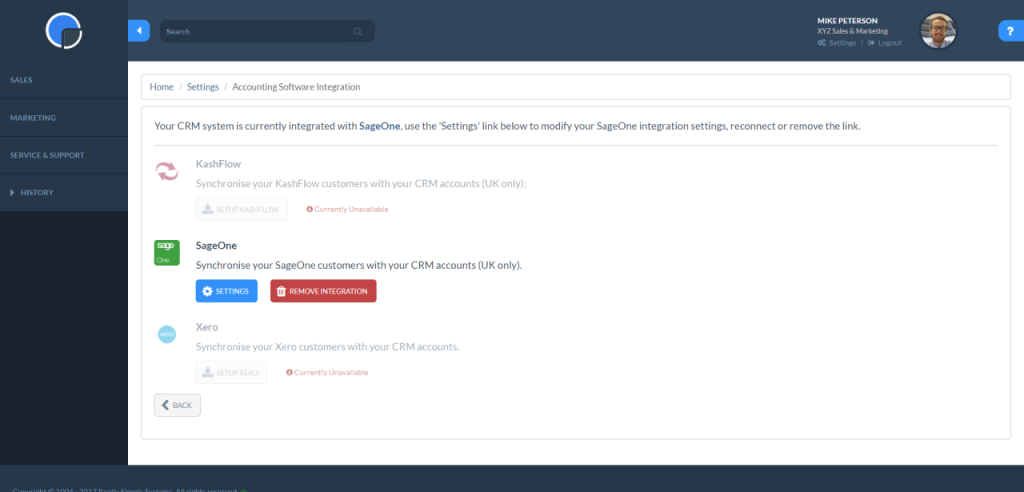

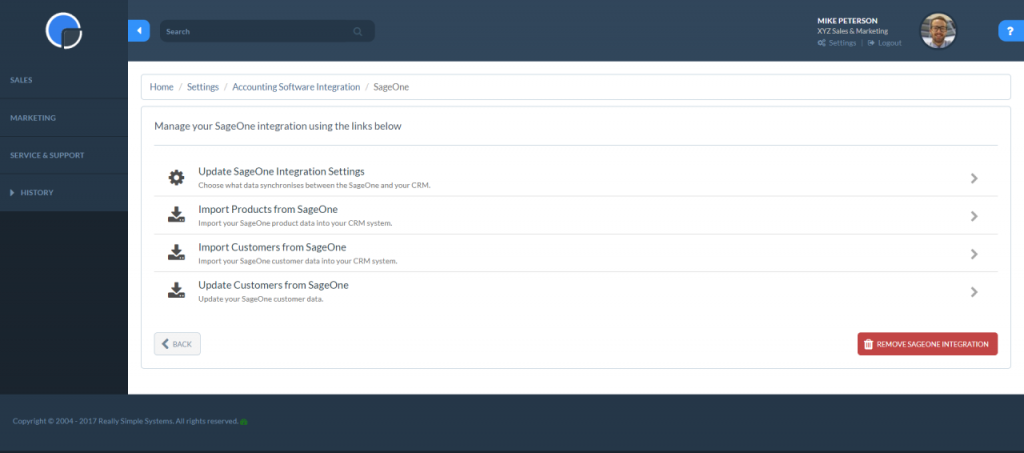

To import the customers and contacts you have in Sage Accounting to your CRM, go to Settings / Integrations and open the Accounting Software section. Under Sage Accounting, click the blue Settings button and this will display a list of options.

Click ‘Import Customers from Sage Accounting’ then ‘continue’.

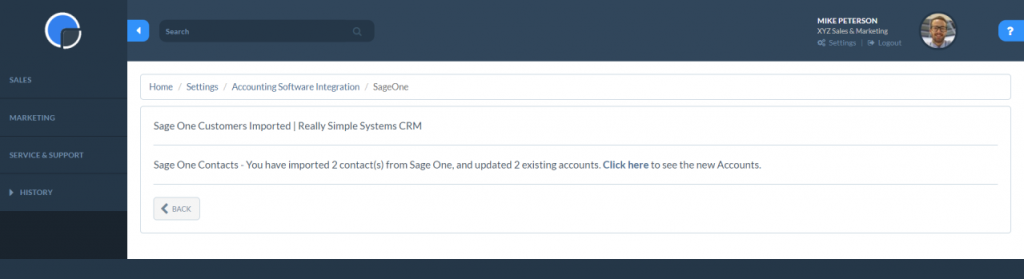

Your customer records will be imported to the CRM immediately and you can click through on the link to view.

Import Products & Services to CRM

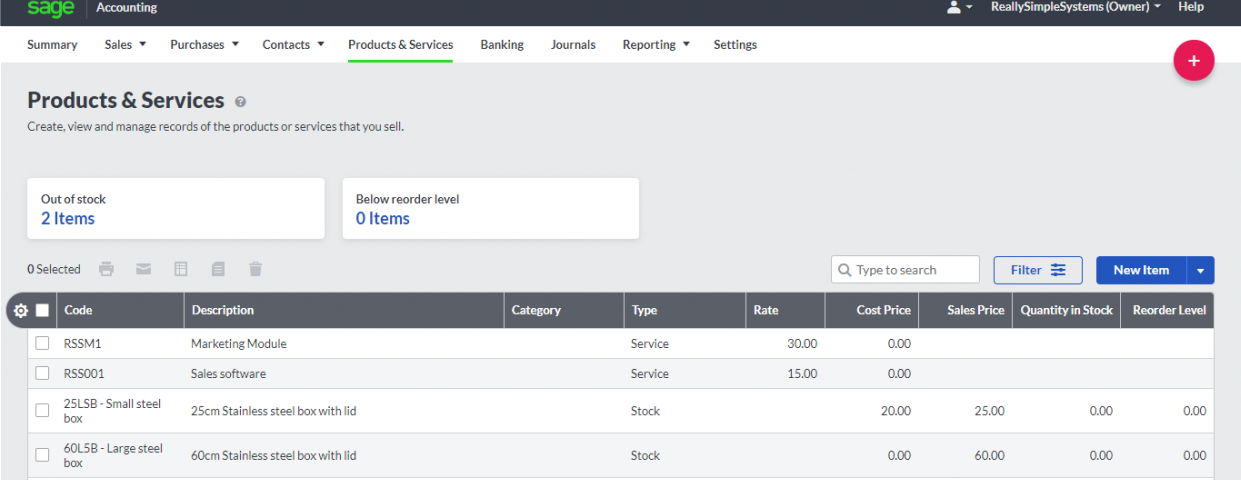

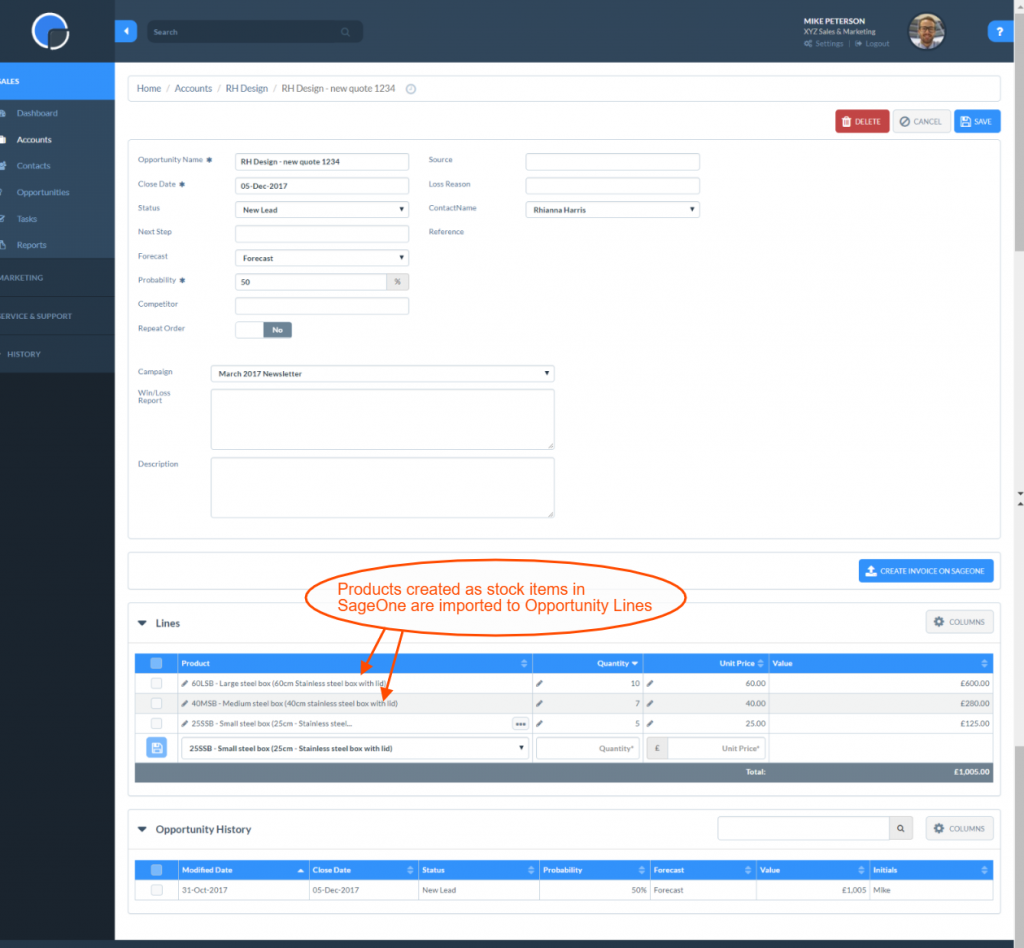

In Sage Accounting you can set up your products and services pricing and manage your stock levels.

You can then import this information to your CRM so it is included in your opportunities. This means when you create a new opportunity you can link the data from Sage Accounting to the sale at product level. Then when you make a sale and create an invoice the stock level will be adjusted accordingly.

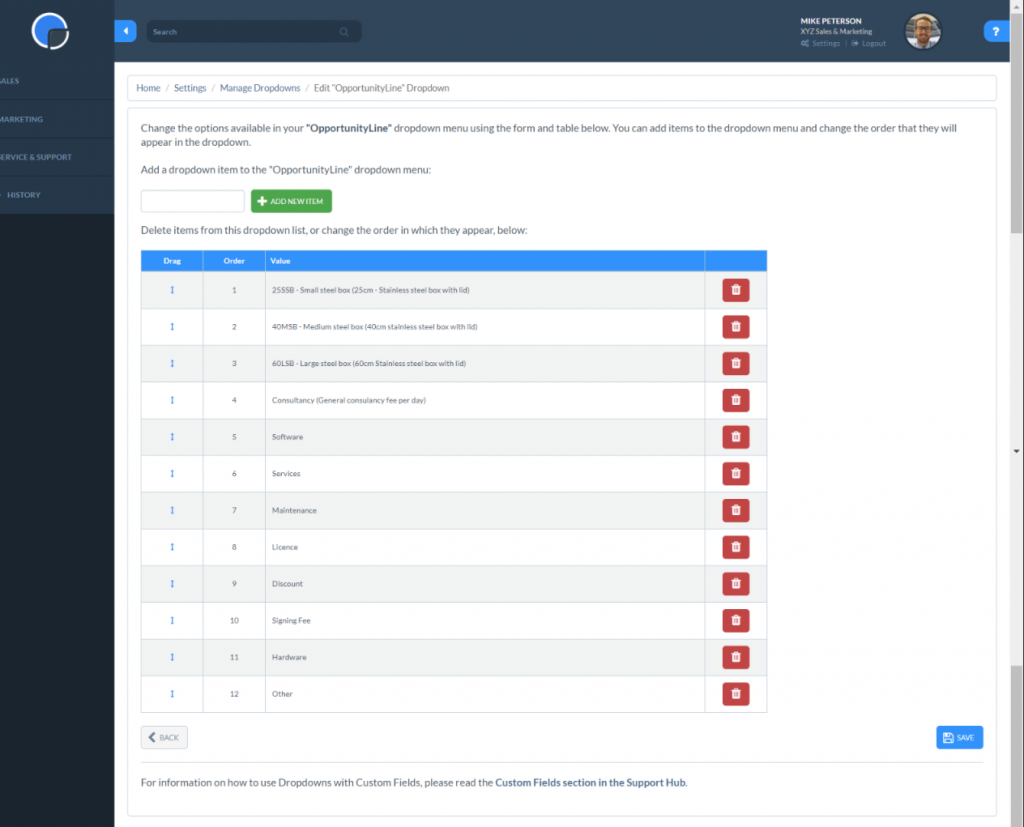

To import your products, in your CRM go to the Sage Accounting Settings button and click ‘Import Products from Sage Accounting’, then ‘continue’. This will import the product to your CRM and clicking the “Click here to see the Products that have been created” link will take you to the page for the Custom Dropdown List for your Opportunity Lines.

When you next create an opportunity in your CRM you will be able to select these products in your Opportunity Lines. If set as a “stock” item in Sage Accounting, when you create an invoice this will reduce the quantity in stock accordingly.

Creating Invoices from Opportunities

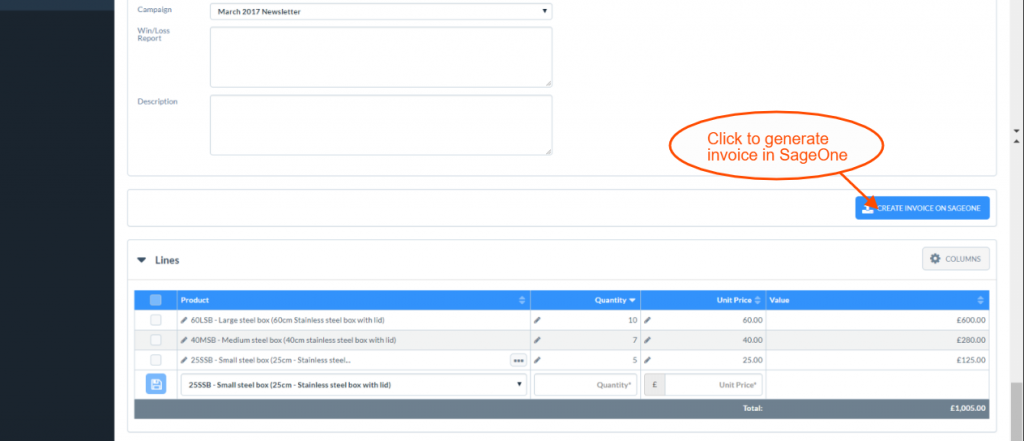

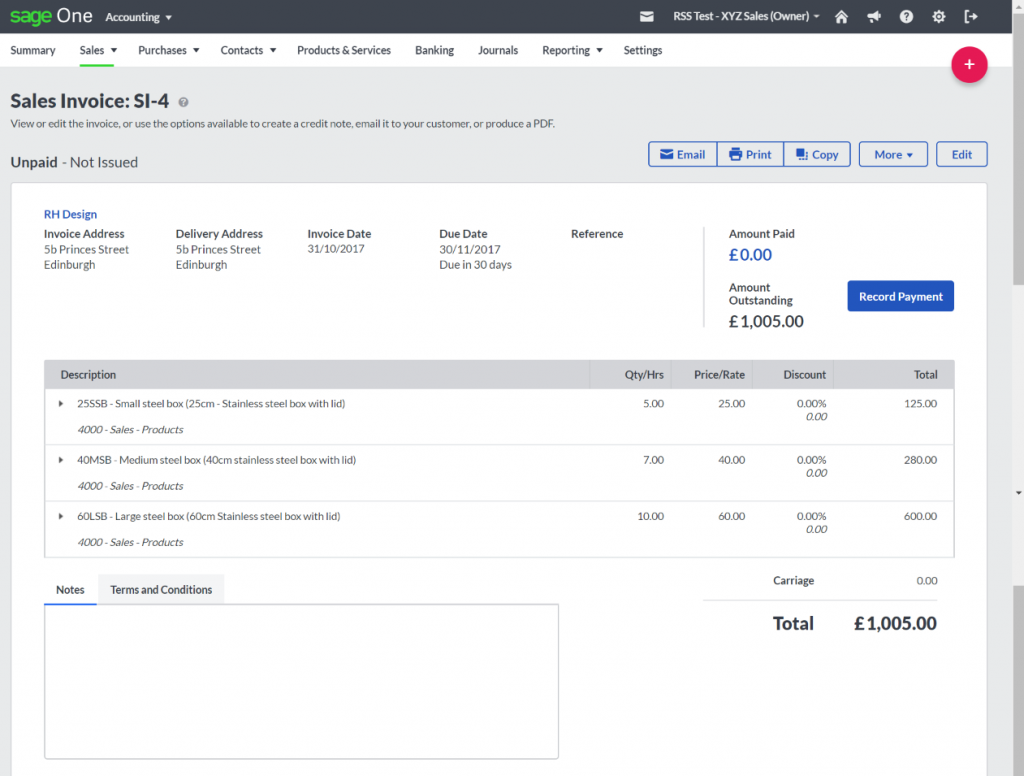

You can create invoices in Sage Accounting directly from your SpotlerCRM opportunities. N.B. the account will need to have an address added first. Once an opportunity has been saved, click the button ‘Create Invoice on Sage Accounting’ and this will generate an invoice in Sage Accounting.

VAT Registration

The Sage Accounting default for VAT is “not registered”. To update this in Sage Accounting go to Settings / Financial Settings then ‘Accounting Dates & VAT’. Selecting a different option from the dropdown list will display the necessary fields.

If you are registered for VAT, your Sage Accounting account lets you select the VAT option required for your invoices.

Once an invoice has been created for an opportunity, you can go back into the opportunity at any time and add more ‘Lines’ and choose the ‘Update Invoice on Sage Accounting’ to add the extra items to the invoice.

In the opportunity there is a link to the invoice number, by clicking on this, it will redirect you to the invoice within your Sage Accounting system.