VAT Payment Regulations

If your billing address is in the United Kingdom we’ll charge you VAT (Value Added Tax) on your CRM subscription.

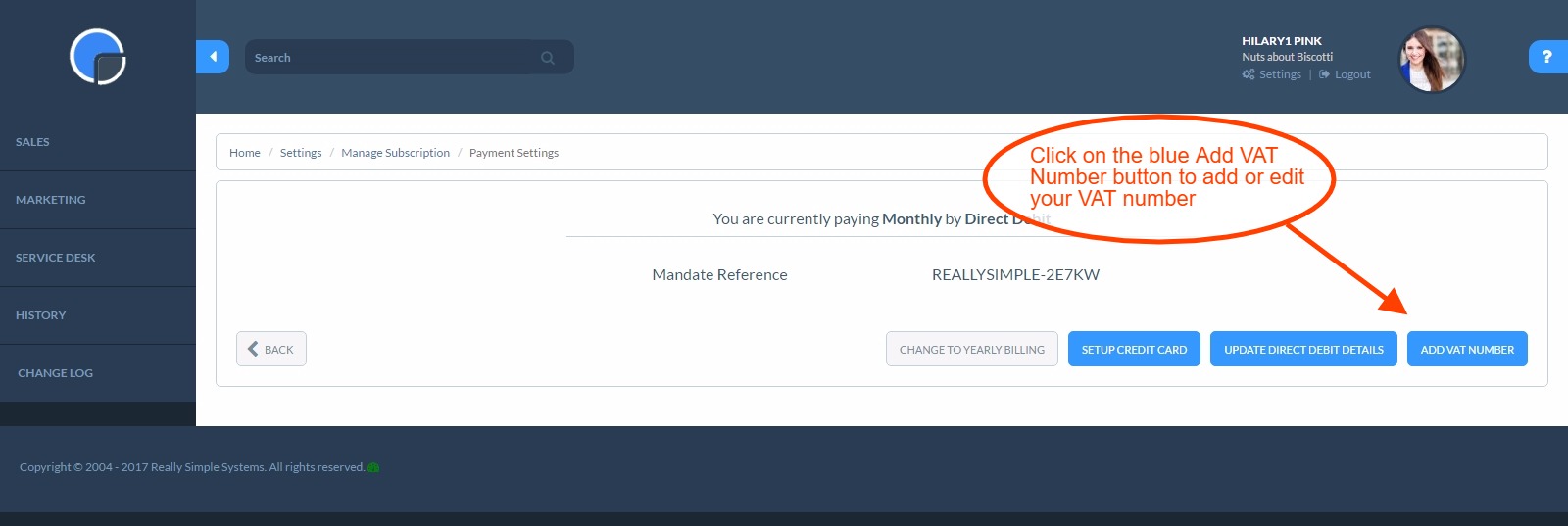

If you are based in the EU (European Community) and have a Tax, VAT/TVA/Mehrwertsteuer number, we will not charge you UK tax. To register your number in our system, go to Settings then Manage Subscription and click on Edit Payment Details select the option to add VAT number.

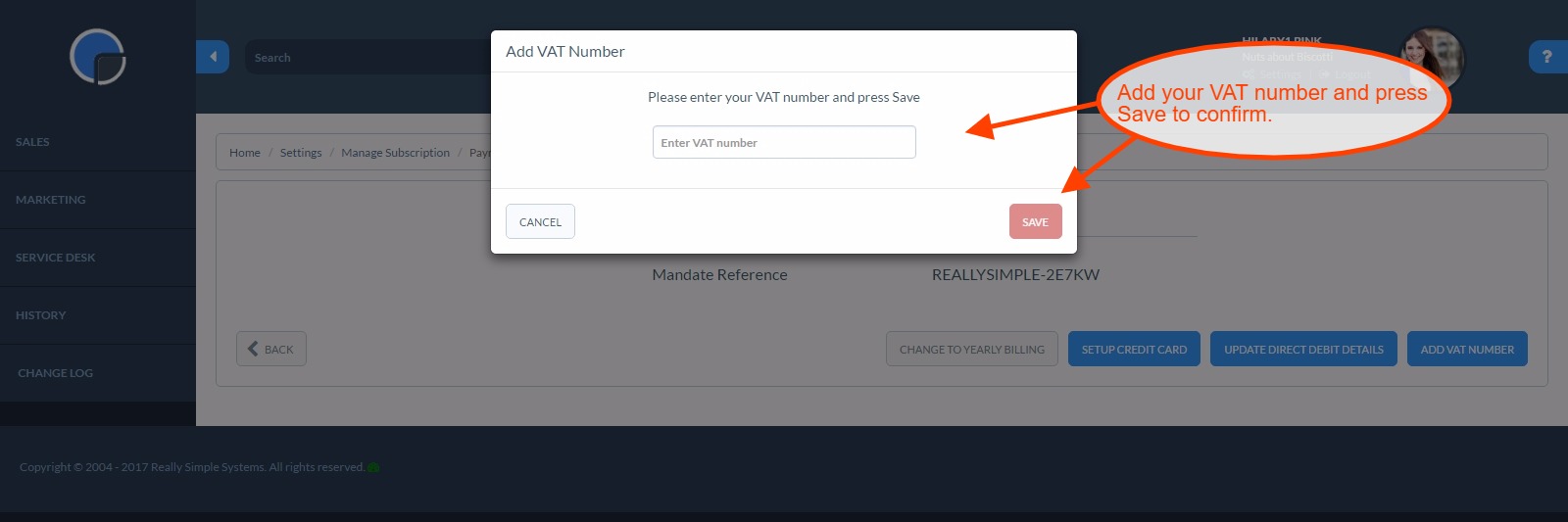

Once you have selected the blue add VAT number button a popup will appear, enter your VAT number here and press the Save button to confirm. Once we have your VAT number we can remove the VAT charge on your future invoices.

If you’re based in the Channel Islands or Gibraltar, you are exempt from VAT, and we won’t charge you. Anywhere else in the world we won’t charge VAT on your CRM subscription.